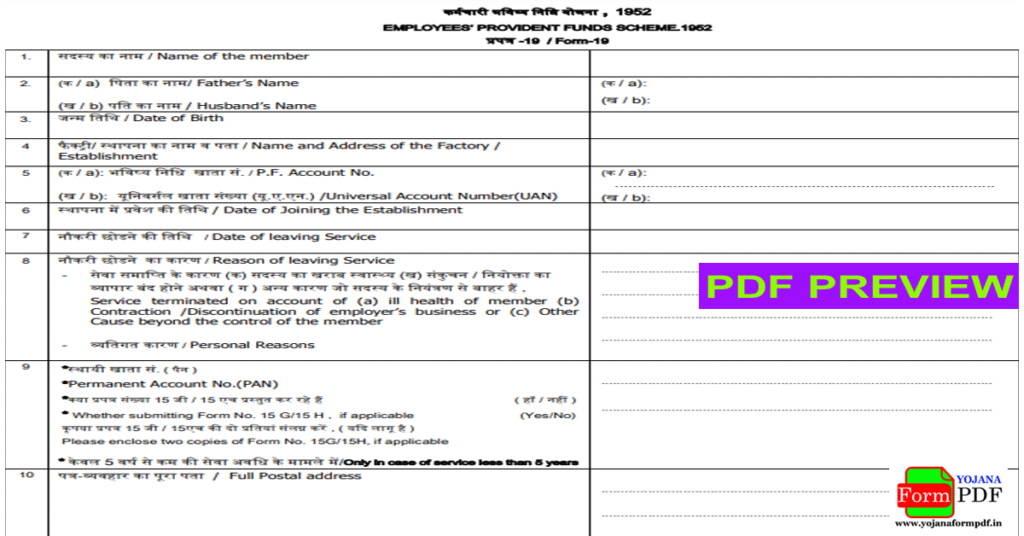

Here Form 15G safeguards the investors from TDS being deducted on the interest income accrued on their investments.Īlso, the Employees Provident Fund Organisation(EPFO) has made it mandatory vide the provisions of Section 192A to submit Form 15G on EPF withdrawal if the amount withdrawn exceeds Rs.50,000/- and the working period is less than continuous 5 years.

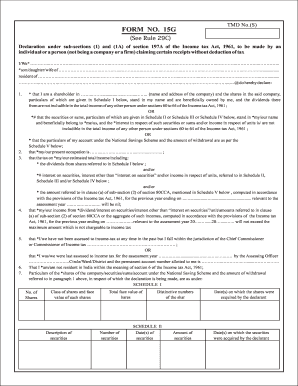

This includes interest income from all the branches of a particular bank. 50,000 with less than serving the five years of service but submits the Form 15G.Form 15G: As per the Income Tax Rules 1962, an individual aged below 60 years, is required to submit a declaration in Form 15G to the respective entities such as Banks, Financial institution for not deducting TDS on the interest income.īanks generally deduct TDS on the interest income accrued from Fixed Deposits, Recurring Deposits if it exceeds Rs.40,000/-(Earlier this limit was Rs.10,000/-) and Rs.50,000/- for Senior Citizens in a financial year from F.Y 2019-20.

50,000, then the EPF portal will deduct TDS. So, if you have a withdrawal amount from your PF account exceeding Rs. Withdrawals, EPFO has clarified the following:įrom FY 2016-17, TDS is not applicable if the PF withdrawal amount is less than Rs. TDS on EPF withdrawals: Considering the requirements of deducting TDS on EPF If PAN is not provided, then the highest slab rate that is 30% shall be applicable. TDS rate: The rate of TDS shall be 10% in case of submission of PAN

Purpose of Form 15G: The purpose of form 15G is to declare that the interest earned by you on savings schemes is not taxable.

In this article, we are going to understand about the Form 15G, the applicability of TDS on EPF withdrawals and how to submit form 15G online by EPFO Portal.

0 kommentar(er)

0 kommentar(er)